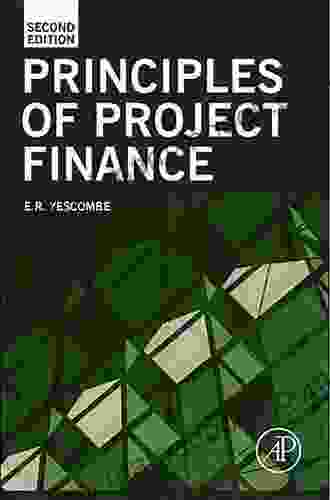

Principles of Project Finance: A Comprehensive Guide by Yescombe

Project finance is a complex and specialized field of finance that involves the financing of long-term infrastructure and industrial projects. It is a unique form of financing that is tailored to the specific risks and rewards associated with these types of projects.

The principles of project finance are based on the concept of risk allocation. The project company, which is typically a special purpose vehicle (SPV),is responsible for all of the project's risks. These risks include construction risk, operating risk, and financial risk.

4.7 out of 5

| Language | : | English |

| File size | : | 3803 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 491 pages |

In order to mitigate these risks, project finance typically involves a number of different financing techniques, such as:

- Debt financing

- Equity financing

- Government guarantees

- Insurance

The project finance market has grown significantly in recent years, as governments and businesses have increasingly turned to this form of financing to fund large-scale infrastructure and industrial projects.

The Principles of Project Finance

The principles of project finance are based on the following key concepts:

- Risk allocation: The project company is responsible for all of the project's risks.

- Non-recourse financing: The lenders have no recourse to the project company's assets or shareholders.

- Project cash flow: The project's cash flow is used to repay the debt and provide a return to the equity investors.

- Independent financial analysis: The lenders and equity investors will typically require an independent financial analysis of the project before they commit to financing it.

These principles are essential to understanding how project finance works. By allocating the project's risks to the project company, non-recourse financing protects the lenders and equity investors from the risks of the project. The project's cash flow is used to repay the debt and provide a return to the equity investors, and the independent financial analysis ensures that the project is viable before it is financed.

The Benefits of Project Finance

Project finance offers a number of benefits to governments and businesses. These benefits include:

- Increased flexibility: Project finance can be used to finance a wide range of different types of projects.

- Reduced risk: The lenders and equity investors have no recourse to the project company's assets or shareholders.

- Access to capital: Project finance can provide access to capital that would not be available through traditional financing methods.

- Improved project management: The independent financial analysis and ongoing monitoring of the project's cash flow can help to improve project management.

Project finance is a valuable tool for governments and businesses that are looking to finance large-scale infrastructure and industrial projects. It offers a number of benefits, including increased flexibility, reduced risk, access to capital, and improved project management.

The Challenges of Project Finance

Project finance is a complex and challenging field. There are a number of risks that are associated with project finance, including:

- Construction risk: The project may not be completed on time or within budget.

- Operating risk: The project may not operate as expected.

- Financial risk: The project may not generate enough cash flow to repay the debt and provide a return to the equity investors.

- Political risk: The political environment in the country where the project is located may change, which could have a negative impact on the project.

These risks need to be carefully considered before committing to a project finance transaction. However, with proper planning and execution, project finance can be a successful way to finance large-scale infrastructure and industrial projects.

Project finance is a complex and specialized field of finance that involves the financing of long-term infrastructure and industrial projects. It is a unique form of financing that is tailored to the specific risks and rewards associated with these types of projects.

The principles of project finance are based on the concept of risk allocation. The project company is responsible for all of the project's risks. These risks include construction risk, operating risk, and financial risk.

In order to mitigate these risks, project finance typically involves a number of different financing techniques, such as debt financing, equity financing, government guarantees, and insurance.

4.7 out of 5

| Language | : | English |

| File size | : | 3803 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 491 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Peter Benchley

Peter Benchley Hadley Mannings

Hadley Mannings Sandra F Rief

Sandra F Rief John Ogwyn Rees

John Ogwyn Rees Kerri Durnell Schuiling

Kerri Durnell Schuiling Pk Davies

Pk Davies Kate Avery Ellison

Kate Avery Ellison Guy De Maupassant

Guy De Maupassant Dr Richard M Fleming

Dr Richard M Fleming Thomas Coskeran

Thomas Coskeran Ken Johns

Ken Johns Loren W Christensen

Loren W Christensen Ton Viet Ta

Ton Viet Ta Bryan Goodwin

Bryan Goodwin Heather Mchugh

Heather Mchugh Christine Platt

Christine Platt Nicole Miyuki Santo

Nicole Miyuki Santo Nick Maggiulli

Nick Maggiulli Colleen Wagner

Colleen Wagner Annie Rachel Cole

Annie Rachel Cole

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Vincent MitchellUnveiling the Enigmatic World of the Gargoyles: The Magic, Guardians, and...

Vincent MitchellUnveiling the Enigmatic World of the Gargoyles: The Magic, Guardians, and... Diego BlairFollow ·10.6k

Diego BlairFollow ·10.6k Logan CoxFollow ·15.9k

Logan CoxFollow ·15.9k Roberto BolañoFollow ·9.9k

Roberto BolañoFollow ·9.9k Brody PowellFollow ·17k

Brody PowellFollow ·17k John MiltonFollow ·5k

John MiltonFollow ·5k Jamal BlairFollow ·4.3k

Jamal BlairFollow ·4.3k George BellFollow ·7.4k

George BellFollow ·7.4k Chadwick PowellFollow ·5.4k

Chadwick PowellFollow ·5.4k

Alexandre Dumas

Alexandre DumasFugitive Telemetry: Unraveling the Secrets of the...

In the realm of...

Caleb Carter

Caleb CarterBlack Clover Vol 25: Humans and Evil - A Journey into the...

Unveiling the Sinister Forces Black...

Israel Bell

Israel BellHow to Make Offers So Good People Feel Stupid Saying No

In today's competitive business environment,...

Simon Mitchell

Simon MitchellWrath of Hades: The Children of Atlantis

An Epic Tale of...

Percy Bysshe Shelley

Percy Bysshe ShelleyStrengthen Your Immune System: Fight Off Infections,...

What is the...

Clark Bell

Clark Bell10 Things I Wish Someone Had Told Me Earlier

As we navigate through life, we accumulate a...

4.7 out of 5

| Language | : | English |

| File size | : | 3803 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 491 pages |